CPA's, Accountants and Tax Pros - Find out how you can add $8,000-$10,000 in annual income by becoming a 911 Tax Relief Partner.

Only 30 spots available - First Come First Serve.

Earn 15–20% referral commissions and add $8,000–$10,000+ in annual income—at no cost to you—by helping your clients get the relief they need.

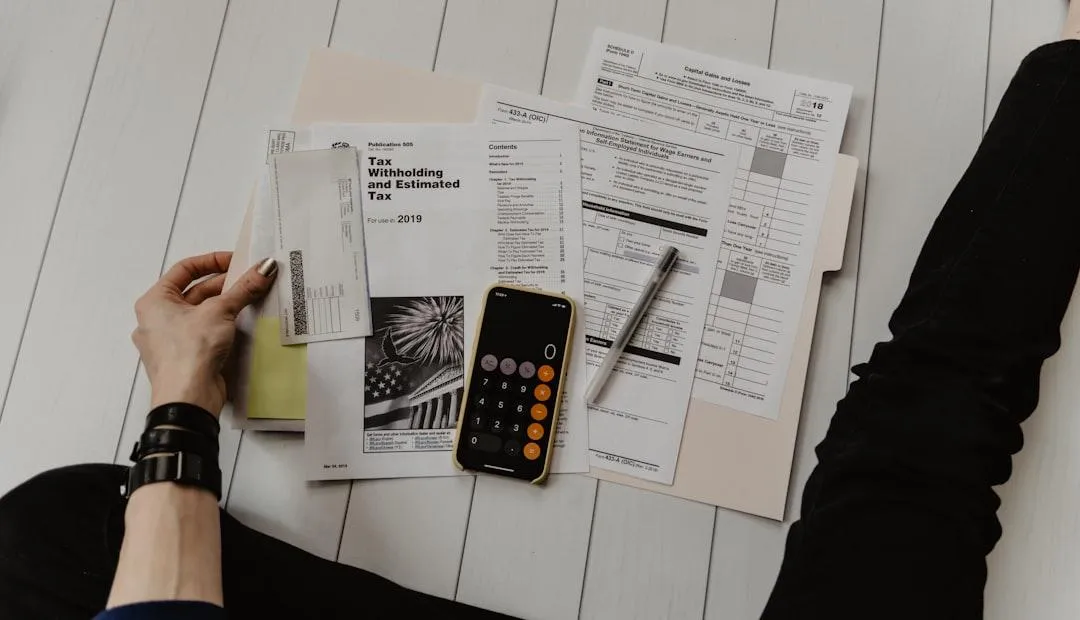

Are you a CPA, tax preparer, or bookkeeper who doesn’t offer tax resolution services—but often has clients facing serious IRS or state tax problems?

Partner with 911 Tax Relief, a trusted tax law firm that specializes exclusively in tax relief, and start earning 15–20% commission for every successful referral—without ever risking your client relationship.

Only 30 Spots Left! Sign Up to Reserve Your Spot.

Hear from Zeke - one of our cpa Referrals.

Certifications & Credentials

Meet Your tax relief Partner

At 911 Tax Relief Law, we’ve spent over 17 years resolving IRS and state tax issues—using licensed experts, proven strategies, and full transparency.

Our Five-Star Rating reflects a commitment to real results, professionalism, and client trust.

We also offer business advisory services to help clients with broader financial goals—with the same care and integrity.

If you’re a CPA, bookkeeper, or tax preparer who doesn’t offer tax relief, we’ll work discreetly under your brand, manage the full process, and even provide co-branded support.

You refer. We resolve. Your reputation stays strong—& you earn.

About Our Referral Partnership

We collaborate with CPAs, accountants, and tax professionals who help clients with tax prep, forgiveness, and savings strategies.

No need to handle tax relief in-house

We manage everything under your brand

You earn 15–20% commission per case

Let’s simplify tax relief—so your clients win, and your business grows.

Why partner with us?

White-label service under your name

Licensed tax attorneys & experts

Hands-free fulfillment from start to finish

Scalable compensation – earn 15–20% per case

Trusted support, real results, no false promises

Only 30 Spots Left! Sign up below.

Facebook

Instagram

X

LinkedIn

Youtube

TikTok